The Ultimate Event Budget Guide (With Examples + Templates)

Thorben Grosser serves as VP of Partnerships and Channel at EventMobi, bringing 15+ years of expertise in strategic event planning and industry leadership. Having guided thousands of event professionals in crafting exceptional attendee experiences, Thorben deeply understands the nuanced challenges planners face in delivering successful events. In his current role, he collaborates with event agencies and association management companies to enhance their strategic capabilities while sharing practical insights on emerging trends and best practices.

With the rising cost of everything from coffee to A/V equipment, creating (and sticking to!) an event budget is more valuable than ever. As the 2025 Global Business Travel Forecast reports, the cost per meeting attendee per day is predicted to increase by 4.3% this year to $169—due to increased food, beverage, venue, and labor costs.

Event budgeting allows you to host events within your organization’s financial means that still achieve your event objectives. Whether you’re looking to increase non-dues revenue, encourage networking, or strengthen sponsor relationships, a proper event budget lets you stay on track.

With 70% of event organizers in North America expecting their meeting spend to increase in the coming year, it’s time to set your organization up for success. To help, we’ll cover the following event budget topics:

- What Is an Event Budget?

- How to Plan Your Event Budget: 7 Steps

- Event Budget Examples and Templates

- Event Budgeting FAQs

By consolidating all of your financial details, event budgeting makes it easier to understand your event cost breakdown, control your event expenses and revenue, and measure your event’s return on investment (ROI).

Want to offset your event budget with sponsorships?

What Is an Event Budget?

An event budget is a financial roadmap for your event. It helps you organize your projected expenses and revenue so you can effectively manage your resources and stay on track to achieve your event goals.

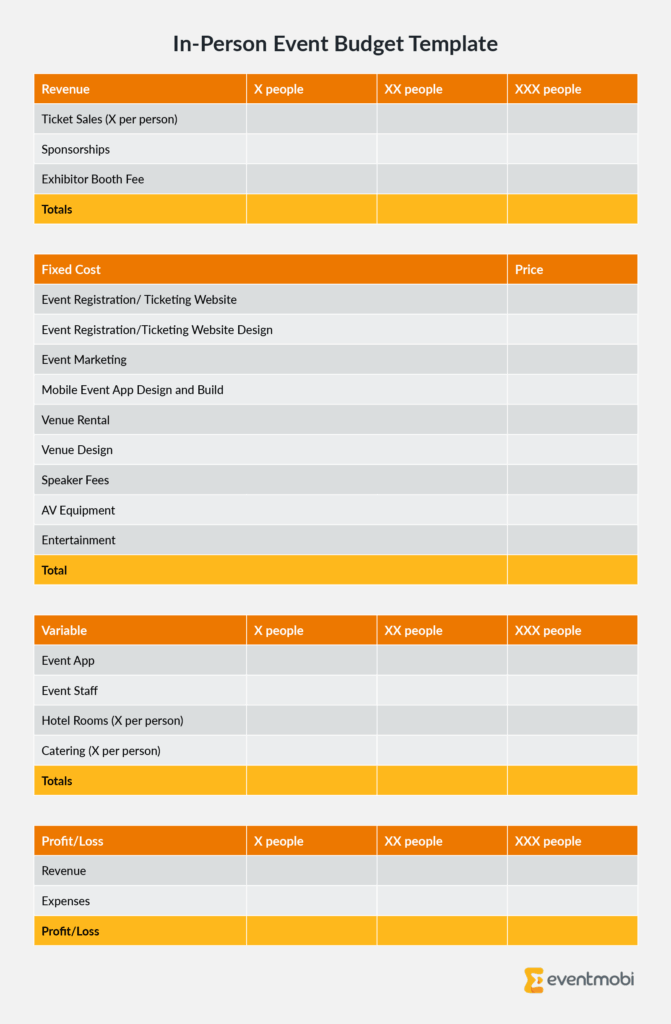

Categories within your event budget may include:

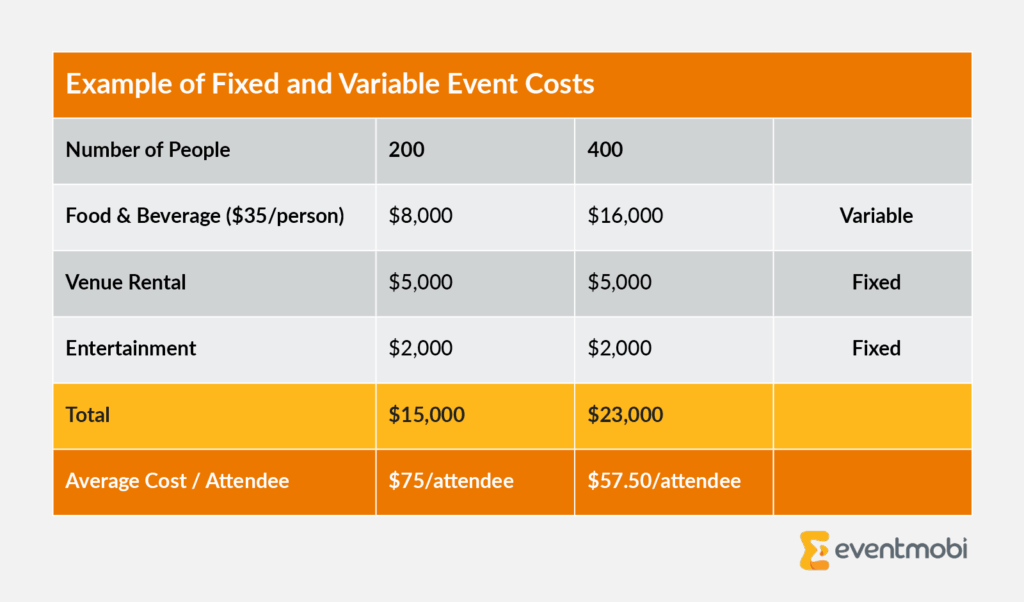

- Fixed costs. Fixed costs are expenses that stay the same regardless of how many attendees join your event. These may include venue rental, entertainment, and event registration software fees.

- Variable costs. Expenses that vary according to your attendee count are called variable costs. Examples include food and beverage and event staff costs.

- Revenue. The money you expect to make from your event is your projected revenue. Common sources of event revenue include ticket sales, sponsorships, and exhibitor booth fees.

- Profit and loss. Considering the above factors, the profitability of your event depends on the number of attendees who show up. To determine how many attendees you’ll need, add a section to your budget summarizing your projected expenses and revenue for different potential attendee counts.

Planning your budget ahead of time prevents your team from overspending and sets realistic expectations for how much you can allocate to different areas of your event. That way, you can better prioritize which aspects you’d like to spend more on. For example, if you have to choose between a larger event venue or an upgraded catering package, you can make an informed, data-backed decision based on which is more important to your team.

Developing a clear event budget also helps you measure your success at the end of your event. In reality, your actual revenue and expenses will likely differ from what you projected. Still, these benchmarks help you determine whether you generated more or less revenue than expected and adjust your budgeting strategy accordingly for future events.

Ultimately, an event budget is a necessary tool for managing your event finances and making careful decisions during the event planning process.

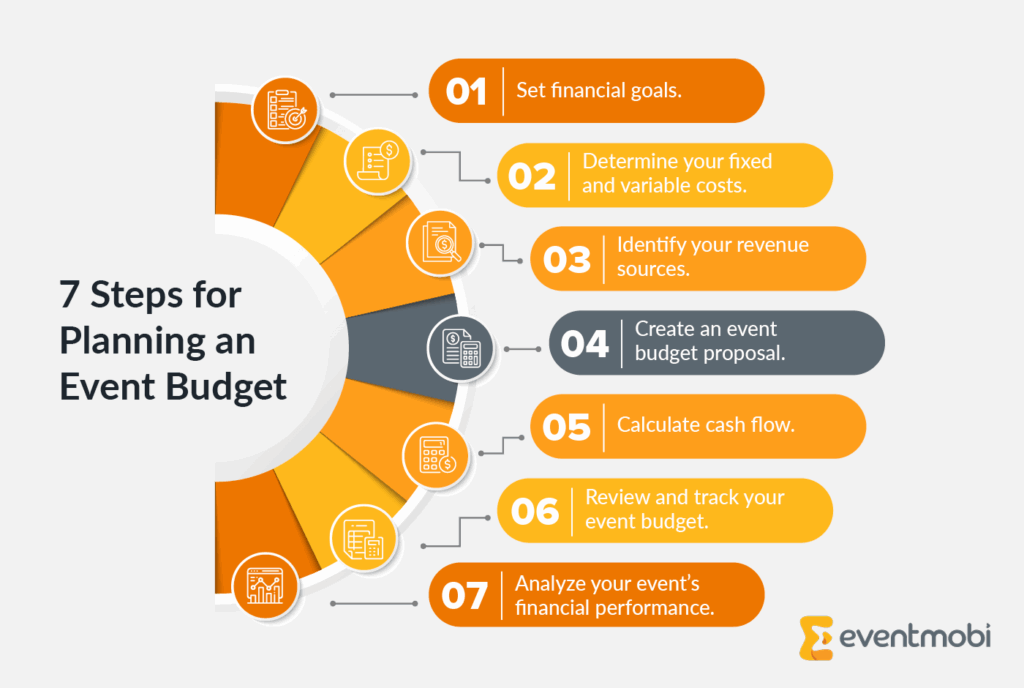

How to Plan Your Event Budget: 7 Steps

Now that you know the main event budget categories, it’s time to begin the event budgeting process. Let’s walk through it step by step so you know exactly how to proceed.

Step 1: Set financial goals for your event.

Prepare an event profit and loss budget and predict as accurately as possible if the event will result in a profit, loss, or break even. What financial success means for your event, however, depends on the type of event and objectives.

For example, you may project your upcoming conference to break even or result in a slight loss, but if you acquire a significant number of new members for your association through the event, you’ll eventually profit through extra dues revenue.

Although you won’t be able to forecast all expenses and revenue from the beginning—and some of these could even change during the planning process—it’s vital to plan your budget considering the most common expenses and revenues, which we’ll dive into next.

Step 2: Determine your fixed and variable costs.

Differentiate between fixed costs and variable expenses. As a reminder, fixed costs do not change based on the number of attendees and are calculated as a total amount. Variable costs change based on the number of attendees and are calculated per person.

Expenses for In-Person Events

According to the American Express Global Business Travel Meetings & Events Global Forecast, this year, 68% of meetings in North America will be in-person only, and 83% of meetings will have an in-person component. Therefore, event organizers will mostly be budgeting for in-person event costs.

The report also notes that event and meeting professionals would prioritize “improving the onsite experience” when using an increased budget. When asked, “What makes a good attendee experience?”, these were the top responses:

- 38% said event content and agenda.

- 27% said venue.

- 25% said destination.

- 24% said social and networking events.

- 24% said food and beverage.

Other costs may include audio/visual, decor, labor, staff travel, marketing, speaker fees, entertainment, and event management software. While every event will have a different ideal cost breakdown based on your goals and budget, keep the attendee experience in mind when budgeting for in-person events. You may even survey past attendees to better understand their priorities and how you can allocate resources to best serve their needs.

Expenses for Virtual and Hybrid Events

Compared to in-person events, virtual and hybrid event costs will focus more heavily on technology expenses to create a stimulating attendee experience regardless of location. These may include:

Audio/Video (A/V) Costs

Audio/visual equipment enables all attendees to experience event content and sessions properly. Hybrid event planners, in particular, should budget for both onsite and remote A/V equipment.

Onsite, aim to have two camera placements with an operator for each, an IMAG operator, and a video switcher. For your remote A/V equipment, you will need a solid, wired, and dedicated internet connection with minimum speeds of 100mbs download and 30mbs upload. You can also use streaming and encoding hardware/software like OBS (free) or vMix (paid) to capture the cameras, presentations, and audio of the presenters.

Having two well-equipped A/V teams allows you to create the best experience possible for your audiences and keep engagement high among virtual attendees.

Livestream and Video Production Costs

Streaming services vary widely. For instance, you can use Zoom to self-produce at a low cost, or some virtual event platforms (like EventMobi) have built-in DIY live streaming tools that allow you to create livestreams within the platform. This tends to be a mid-level price option.

For higher-end budgets, you may prefer to hire a full-service professional production team like EventMobi’s GoLive! Production Team, or an outside A/V company.

Step 3: Identify your revenue sources.

To cover expenses, consider different revenue avenues like:

- Advertising

- Concession

- Booth rentals

- Management fees

- Registration

- Sponsorship

Use budget planning tools such as Excel or Google Sheets to track these revenue sources. Group your revenues in categories relevant to your event, such as “site,” “decorations,” or “publicity.” For hybrid events, consider broader categories like “in-person” and “virtual,” then subcategorize accordingly.

Forecasting expenses and revenues is a critical aspect of budget planning. Review past event finances and source quotes for new costs. Remember to keep all invoices and receipts to back up your budget.

Allocate a contingency fund for unexpected expenses. Finally, ensure your event is financially viable before moving to other aspects like venue selection, promotions, and staffing.

Step 4: Create an event budget proposal.

An event budget proposal is a document or presentation you’ll put together for leadership to sign off on. Fortunately, if you’ve already put together your projected event budget, you’re more than halfway through creating a solid budget proposal. In addition to your expected revenue and expenses, your proposal should include:

- The stated purpose and goals of your event

- Data about past events you have hosted

- Information about similar industry events

- Contingency plans for your budget

- Potential overages for your budget

- Information on how you will measure and report ROI on your event

Discuss the proposal with key stakeholders and make adjustments as needed based on their recommendations.

Step 5: Calculate cash flow for your event.

Cash flow is a measure of how much money you have on hand to cover event expenses. Calculating cash flow allows you to prioritize spending on essential items first, ensure sufficient cash availability at any given time, and monitor profitability.

To calculate your cash flow, add all your revenues and subtract the uncollected accounts receivables (money owed to you for services/work performed). This is your cash on hand before expenses. If you then subtract all of your accounts payable (money you owe for services/work provided to you) from that number, you will have your cash on hand. If the number is positive, you have a positive cash flow.

Cash Flow Calculation

All Revenues – Uncollected Accounts Receivable = Cash on Hand Before Expenses

Cash on Hand Before Expenses – Accounts Payable = Cash on Hand

Starting cash is the amount of money you have readily available at the start of any given period.

Step 6: Review and track your event budget.

As mentioned earlier, not all expenses can be forecasted, and your budget will likely change during the event planning process. Therefore, it is crucial to review and track your budget as you go.

If possible, arrange a meeting with your accounting or financial officer to review your event budget’s format. This will help ensure you’re in good shape before continuing the event planning process.

As demands for your meeting or event might change, it’s also a good idea to confirm who would have the authority to spend beyond the approved budget in advance. However, the earlier-mentioned contingency fund will come in handy when dealing with unplanned expenses.

It is also important to track your budget throughout your event, including the planning stages. Several helpful technology solutions, like Expensify, will support this process.

Transferring your financial systems to a cloud-based system will enable you to manage your financial operations anytime, anywhere. Some examples of financial management software include FreshBooks, and Certify.

Step 7: Analyze your event’s financial performance.

After your event, revisit the success measures and benchmarks you set. In the past decade, new technologies have enabled planners to measure an event’s overall performance in multiple ways. Using qualitative and quantitative event data, you can better understand your event’s performance and show impact.

Return on investment (ROI) is a performance measure used to evaluate the success of your event. You might also want to compare different budgeting strategies based on their ROI. For example, do you get a higher ROI from the money you invest in outbound marketing or from nurturing your existing attendee base?

Moreover, there are additional ways to measure non-monetary business impacts that will help you calculate your event ROI, for example:

- Social Listening

- Event Surveys

- Event App Insights and Engagement

- Sponsor Recognition

The EventMobi Event Management Platform offers advanced analytics to enable you to calculate your event ROI and easily share it with stakeholders and sponsors. With Eventmobi, you can track:

- Attendance numbers, both on a macro and micro level

- Traffic to specific sections of the platform

- Attendee interest, engagement, and actions

- Content viewing duration (including sponsored and non-sponsored video views, banner clicks, and more)

These data points can highlight the most valuable leads to sponsors whilst demonstrating the ROI of participating in your event.

Calculate your event ROI with event management software.

Event Budget Examples and Templates

Now that you know what an event budget consists of, what does it actually look like? Let’s review some examples and event budget templates you can use.

Event Budget Example #1: In-Person Event

Let’s say you’re running an entirely in-person event for a single weekend at a hotel. You expect anywhere from 500 to 1,000 people to attend, with the ultimate goal of generating revenue. You anticipate hiring more booth rentals and sponsorships if you draw a larger crowd, but you’ll also require more staff and accommodations.

Here’s an example of what that event budget might look like:

Laying out your event budget like this lets you see exactly how any given scenario will turn out for your profit or loss.

In this example event budget, you would profit if you could attract at least 750 attendees, and your profit would increase the more attendees you register. However, you will lose money if you only manage to get 500 people to attend.

With this information in mind, you can take well-informed next steps, such as:

- Shifting more money into marketing

- Scouting more affordable venues

- Recruiting more sponsors

- Adjusting ticket prices

Watch the EventMobi Product Tour to learn how to create on-brand, on-budget events with a single, powerful platform.

Event Budget Template #1: In-Person Event

Here is a blank version of an in-person event budget template you can use to map your own event revenue and expenses:

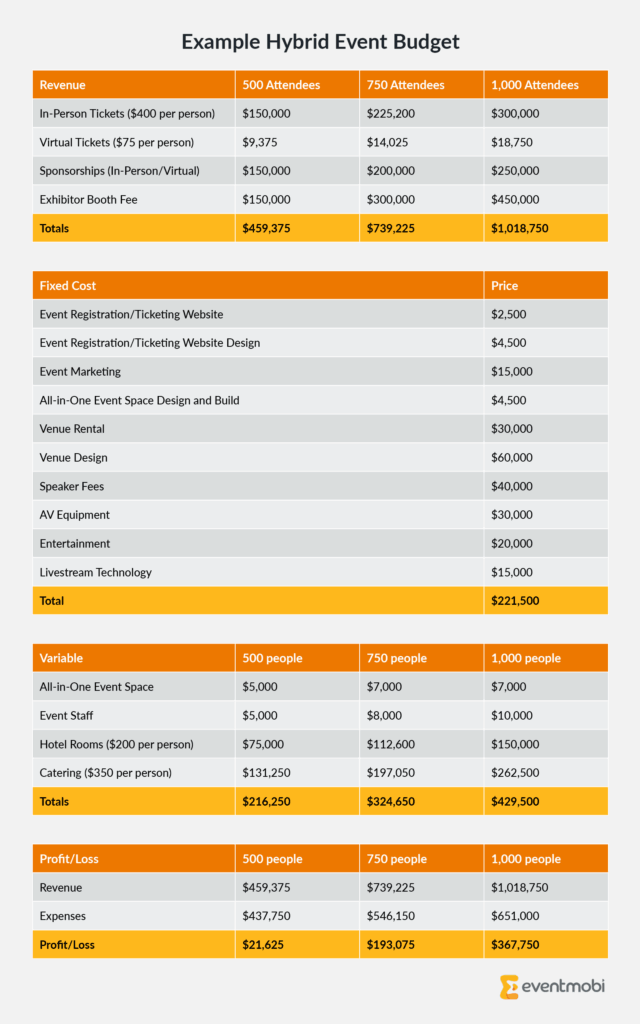

Event Budget Example #2: Hybrid Event

Let’s look at an event budget example for a hybrid event:

This event budget example makes a compelling case for hybrid events. The high ticket price for in-person attendees is justified by the expenses associated with venue rental, design, F&B, and live entertainment.

Moreover, if you communicate how unique the onsite experience will be when marketing your event, you could even increase ticket prices beyond what you would charge for a strictly in-person event.

Meanwhile, virtual attendees require fewer resources and expenses, but the lower ticket price reflects that they will miss out on the multi-sensory elements of the in-person event experience.

Event Budget Template #2: Hybrid Event

Here is a blank version of a hybrid event budget template you can use to map your own event revenue and expenses:

Event Budgeting FAQs

Why is event budgeting important?

Event budgeting is important because it allows you to plan an event within your organization’s financial means and avoid overspending. Creating an event budget allows you to allocate resources effectively and prioritize spending based on your event goals. Additionally, an event budget helps you stay on track and measure your event’s success by comparing your projected revenue and expenses to your actual revenue and expenses.

What expenses should my event budget include?

In-person event budgets should include expenses like venue, food and beverage, audio/visual, decor, labor, staff travel, marketing, speaker fees, entertainment, and event management software.

Virtual and hybrid event budgets focus more on technological elements like audio/video, livestreaming, and video production but also require funds for marketing, speaker fees, and event management software.

How should I estimate costs?

Start by evaluating your financial data from previous events to determine the revenue you’ve generated and expenses you’ve incurred in the past. Then, adjust these numbers for your projected number of attendees. For any new expenses, request quotes from the associated vendors to get a better idea of what to expect.

How should I track and manage event expenses?

Use a spreadsheet or accounting software to keep track of your projected revenue and expenses. Categorize your revenue and expenses so you know how much you’re spending in each area, and update them regularly as your event plans progress.

What happens if I go over budget?

Regular budget monitoring should prevent going over budget. If your expenses start to rise, work with your team to identify areas where you can reduce spending. For example, if your venue rental costs are high, you may downgrade your catering package to compensate for this expense.

What is a contingency fund?

A contingency fund represents money set aside for unexpected expenses or emergencies, such as additional staffing needs or technological malfunctions. Build a contingency fund into your budget to prevent unforeseen challenges from impacting your event finances.

How can I reduce costs while still delivering a high-quality event experience?

Ensure high quality while minimizing costs by negotiating with vendors, seeking nonprofit or industry discounts, recruiting volunteers, soliciting in-kind donations, securing sponsorships, and reducing or eliminating costs that won’t impact the attendee experience.

Event Budgeting is Key to Your Success

Evaluating and analyzing your event’s financial performance can be complicated, but doing so allows you to make smarter choices for future conferences or meetings.

Event budgeting tools are just one aspect of how event planners today take advantage of event technology.

With an all-in-one event platform like EventMobi, you can unlock more ways to add value for attendees, sponsors, exhibitors, and more–which can translate into new revenue streams and opportunities for financial success.

Book your demo of EventMobi today to learn how a powerful, cost-effective platform can help you create the right attendee experience at every stage of your events.